![]()

David L. Mullis dmullis@gw.uscs.edu is an Associate Professor of Finance, School of Business and Economics, University of South Carolina at Spartanburg. Theodor Kohers kohers@ra.msstate.edu is a Professor of Finance and International Business, Mississippi State University.

If you do not like the background color, you can change it by highlighting the color you prefer in the scroll box below.

I. INTRODUCTIONIn recent years, American business has been attempting to downsize in an effort to become more cost efficient and competitive in an increasingly world-wide market. While this force appears to represent the general business environment, it is particularly relevant for occupational credit unions. Almost 80 percent of the credit unions in the U.S. are occupational in nature, meaning that all their members, borrowers, savers and, in many cases, their management as well are all employed by the same company.

As these credit unions' parent companies go through structural changes, the impact on the symbiotic credit union has to be apparent. Downsizing means fewer potential members, while merger or acquisition could mean more members or total liquidation due to duplication. Downsizing and cost efficiency can mean a reduction in parent company (sponsor) subsidies, often pointed to as a competitive advantage of credit unions over other thrifts. To regulators and trade groups, the shift has been from new "start-up" credit unions to assisting existing credit unions to increase in size and to become more efficient in competing with larger thrifts and banks, a shift which also lead to a greater relaxation of the common bond requirement of credit unions.

The purpose of this paper is to examine structural changes which occurred in occupational credit unions as shown by operating characteristics for the years 1990 and 1994. Since the changes in credit unions should be most apparent at the extremes, for comparison purposes, credit unions are broken down into groups of small and large institutions. Small credit unions consist of size categories #1 and 2, while large institutions are made up of sizes #5 and #6 of the National Credit Union Administration size classification. In addition, occupational credit unions are divided into two categories based on the nature of the parent company's business. Stable credit unions have parent companies such as state and local governments and colleges and universities. In contrast, unstable credit unions are represented by textile, furniture, and construction companies, among others. Stable and unstable credit unions are hypothesized to display different operating characteristics based on varying degrees of risk which could be intensified by the prevailing phase of a business cycle.

The importance of the parent company pass-through risk to occupational credit unions can not be overemphasized. Public university credit unions show little or no change in their financial ratios during recessionary periods while a pro-cyclical textile company credit union will show increased delinquency, higher liquidity, and other differences in financial structure associated with higher risks.

Credit unions have received attention in the literature on a variety of topics varying from a general model of their operation (see, for example, Black and Dugger [1981], Flannery [1974], Navratil [1981], Smith [1984], Smith et al. [1981]); economies of scale (e.g., Benston [1972], Kohers and Mullis [1988], Koot [1978], McNulty et al. [1995], Murray and White [1983], Taylor [1972], Wolken and Navratil [1980]); borrower or saver orientation (See, for example, Kohers and Mullis [1987].); and the impact of parent company business on occupational credit unions (e.g., Kohers and Mullis [1986]).All of these studies were conducted in the pre-1990 environment and, therefore, before the subsequent, widespread corporate downsizing.

The purpose of this paper is to examine structural changes which took place in occupational credit unions as reflected in operating characteristics for the years 1990 and 1994.

This paper provides useful information about the possible impact size differences and the parent organization's business have on occupational credit unions after the passage of FIRREA. For example, if the pro-cyclical (i.e., unstable) institutions show parallel swings in behavior much as the parent organization, then the regulation and management of credit unions should be more concerned with the nature of the parent company business. In addition, what are the implications of significant differences in behavioral characteristics based on credit union size?

The remainder of this paper is organized as follows: Section II explains the methodology, data selection, and procedure for detecting differences in operating characteristics between small and large credit unions as well as stable and unstable institutions. The findings are discussed in Section III. The paper concludes with a summary in Section IV.

II. RESEARCH METHODOLOGY

The research proceeded in the following sequence. First, samples were drawn from the occupational category to reflect 'small' and 'large' credit unions, holding constant their respective type of parent company category and limiting the selection to federally-chartered, federally-insured institutions (which make up nearly two-thirds of all credit unions). This procedure was implemented for the years 1990 and 1994. In selecting the time frame, aside from being recent, a consideration was the capturing of the possible effects of a business cycle on the results. This objective was accomplished by including 1990, where the first seven months were expansionary while the remaining five months were contractionary. In contrast to 1990, the economy expanded during all of 1994, the second year examined. In the next step, t tests were performed on sets of measures of credit union operating characteristics derived from the hypothesized relationships described later in the paper. The specific hypothesis tested can be expressed as follows:

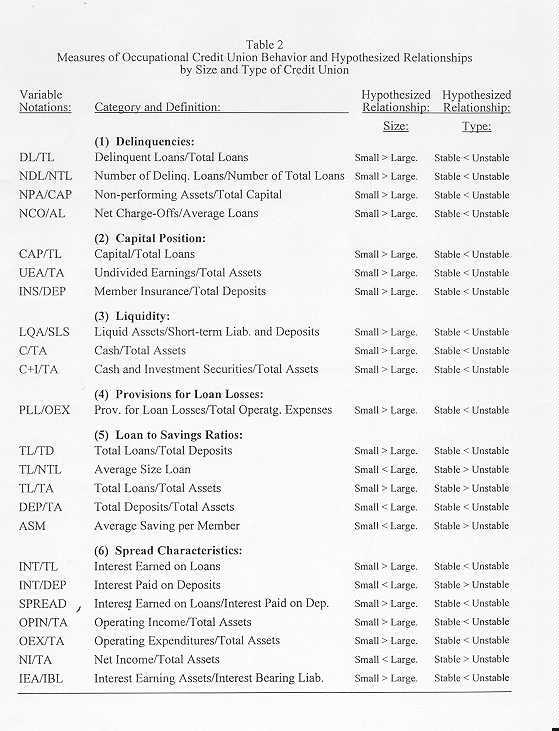

The credit union operating characteristics are proxied by 23 financial ratios identified later in the paper (See Table 2.).

The above-described procedure allows for the comparison of small and large credit unions to determine if significant differences in their respective operating characteristics existed. Also, by holding constant the nature of the parent company business, one can determine if patterns of operating characteristics can be identified that are independent of an institution's size.

Data and Sample

The financial ratios used to identify operating characteristics of credit unions were developed from the data base of regulatory reports filed with the National Credit Union Administration (NCUA) which, as of 1994, contained information on over 12,000 credit unions. Cross-sectional data for 1990 and 1994 were utilized as representatives of credit union operating characteristics. The samples were chosen in such a way that important extraneous influences would be held constant. In order to accomplish the first objective, which is to ascertain if the size of a credit union had a noticeable impact on the institution's operating characteristics, credit unions were selected by size category. To avoid different regulatory constraints, only federally-chartered, federally-insured institutions were included in this study. Grouping by size was accomplished by using the NCUA size classification. Currently, the NCUA lists six different size categories for the total population of over 12,000 credit unions. The NCUA's size categories currently in use are as follows:

Size Category: CU Asset Range:

- $25,000-500,000

- $500,001-2,000,000

- $2,000,001-10,000,000

- $10,000,001-50,000,000

- $50,000,001-100,000,000

- Over $100,000,000

Since changes in credit union behavior should be most apparent at the extremes, credit unions were classified as small and large. Small institutions were chosen from size categories #1 and 2, while the large credit unions were selected from size categories #5 and 6.

Thus, to proceed with the first objective, that is, determine if size differences had an effect on credit union operating characteristics, the mean values of the behavioral variables for stable and unstable institutions were compared to each other and their respective p-values for the differences in mean values were examined by credit union size category. This procedure reveals if a reasonably consistent pattern existed for the tested operating characteristics, regardless of size.

To accomplish the second objective, that is, determine if the cyclical nature of the parent organization had an appreciable impact on a credit union's operating behavior, occupational credit union categories were selected on the basis of (a) stable (i.e., non-cyclical), and (b) cyclical (i.e., unstable). The occupational category is based on the principal activity of the employer-sponsor and assumes some type of employment relationship in the membership. The following types of credit unions were considered in the stable category:

SIC Numbers

701 Federal Government - Civilian.

702 Federal Government - Military.

703 State Government.

704 Local Government.

706 Education - Colleges and Universities.

707 Education - Elementary and Secondary.

Stable credit unions are assumed to go through relatively few changes in their operating characteristics during changes in the business cycle. Stable parent companies (organizations) do not experience employment instability and the resulting employee income fluctuations that would pass through to the credit union and change its financial picture. Along the same lines of reasoning, the credit union would not anticipate any change and automatically adjust.

The second credit union category, consisting of more cyclical institutions, was comprised of the following types:

SIC Numbers

202 Textile Mill Products.

203 Apparel and Other Finished Products Made From Fabrics.

204 Lumber and Wooden Products, Except Furniture.

205 Furniture and Fixtures.

213 Primary Metal Industries.

214 Fabricated Metal products, Except Machinery and Transportation Equipment.

215 Machinery Except Electrical.

217 Transportation Equipment - Motor Vehicles.

401 Wholesale.

402 Retail Trade.

601 Services.

603 Construction.

These unstable credit unions display different operating characteristics than "stable" credit unions. They maintain higher liquidity, greater capital positions and reserves for loan losses in anticipation of pass through income instability from the parent company to the members.

For a more detailed discussion of the occupational type categories, refer to the recently revised NCUA type-of-membership classification system.

Using the sample selection criteria previously described, the following sample sizes resulted:

Table 1

Sample Description by Size and Type

| Size Category | 1990 Stable CUs Unstable CUs |

1994 Stable CUs Unstable CUs |

| 1 | 205 240 | 99 113 |

| 2 | 510 301 | 363 213 |

| Total, Small CUs | 715 541 | 462 326 |

| 5 | 89 28 | 88 33 |

| 6 | 86 23 | 137 31 |

| Total, Large CUs | 175 51 | 225 64 |

Hypothesized Differences in Credit Union Behavior

This study tests the hypothesis that occupational credit unions behave differently depending on size. Theory and previous studies suggest that these behavioral differences are apparent in financial ratios which characterize management behavior. (Refer to Table 2 for a more detailed description of each variable and the hypothesized relationships.) Small and large credit unions were hypothesized to show differences in the following areas:

- Delinquencies.

- Capital Position.

- Liquidity Position.

- Provisions for Loan Losses.

- Loan to Savings Ratios.

- Spread Characteristics.

The hypothesized relationships between stable and unstable credit unions are as follows (For a summary, see Table 2 below.)

(1) Delinquencies: Unstable credit unions are assumed to have higher delinquency rates than credit unions with stable parent company business. This difference would, of course, be greater during a recessionary time period (e.g., 1990) than during a period of growth in the economy (e.g., 1994). Four different ratios were used to measure delinquency and the resulting loan losses. They are:

- (a) Delinquent Loans/Total Loans.

- (b) Number Of Delinquent Loans/Number Of Total Loans.

- (c) Non-Performing Assets/Total Capital.

- (d) Net Charge-Offs/Average Loans.

(2) Capital Position: Due to greater cyclical risk, unstable credit unions would need greater safety, as measured by their capital position, and therefore would maintain greater capital ratios. A credit union’s capital position was measured by the following ratios:

(a) Capital/Total Loans.

(b) Undivided Earnings/Total Assets.

(c) Member Insurance/Total Deposits.

(3) Liquidity: Unstable credit unions are hypothesized to have need for greater liquidity positions than stable credit unions to compensate for greater cyclical risk and to prepare for a drain on funds resulting from savings withdrawal and small signature loans during an economicdownturn. An institution's liquidity was proxied by the following three ratios:

(a) Liquid Assets/Short-Term Liabilities And Deposits.

(b) Cash/Fotal Assets.

(c) Cash And Investment Securities/Total Assets.

(4) Provisionsfor Loan Losses: Due to greater risk, unstable credit unions are hypothesized to experience greater loan losses attributable to the instability of their members' employment during an economic downturn. Accordingly, management should anticipate these greater losses and have higher percentage provisions for these anticipated losses. The ratio of "Provisions for loan losses/Total operating expenses" is used to measure this difference.

(5) Loan to Savings Ratios: Unstable credit unions are expected to experience greater loan to savings ratios compared to their more stable counterparts due to increased withdrawal of savings and increased loan demand during recessionary economic times. Unstable credit unions should also experience an increased number of "small-dollar-amount-qualifying deposits". The following ratios were used to represent loan-to-savings relationships:

- (a) Total Loans/Total Deposits.

- (b) Average Size Loan.

- (c) Total Loans/Total Assets.

- (d) Total Deposits/Total Assets.

- (e) Average Saving Per Member.

- (f) Interest-Earning Assets/Interest-Bearing Liabilities.

(6) Spread Characteristics: Stable credit unions, due to seasonal risk relative to their unstable counterparts, should be able to operate with a lower overall spread, thus paying more on deposits and charging less on loans. Additionally, their cash flow being more predictable, stable credit unions should experience greater operational efficiency. Ratios used to proxy spread characteristics include:

- (a) Interest Earned On Loans.

- (b) Interest Paid On Deposits.

- (c) Spread (Interest Earned On Loans/Interest Paid On Deposits..

- (d) Operating Income/Total Assets.

- (e) Operating Expenditures/Total Assets.

- (f) Net Income/Total Assets.

- (g) Interest-Earning Assets/Interest-Bearing Liabilities.

III. RESULTS

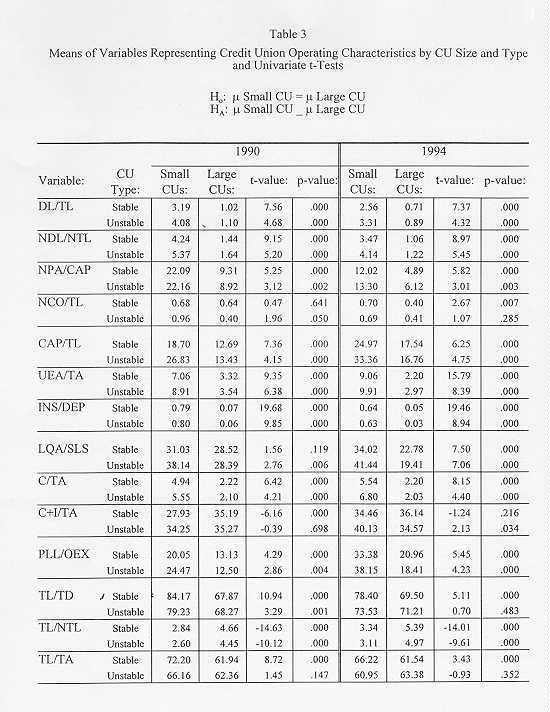

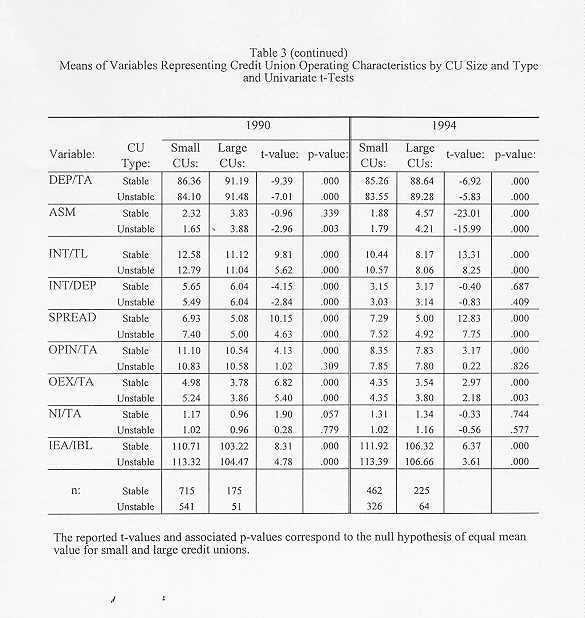

Table 3 below reports the results of the t tests for each variable. Specifically, the table presents the findings by credit union size category (i.e., "small" for size categories #1 and 2, and "large" for size categories #5 and 6), and by credit union parent company business (i.e., "stable" versus "unstable"). Furthermore, the table is divided vertically into two panels, one representing the findings for 1990, a recessionary year, the other one for 1994, a year of economic expansion.

The reported t-values and associated p-values correspond to the null hypothesis of equal mean value for small and large credit unions.

Virtually all of the results for the comparison of small and large credit unions were as anticipated. Small institutions operated with greater delinquencies, larger capital positions, more liquidity, larger provisions for loan losses, greater loan to savings ratios, lower average size loans, a larger proportion of their assets in loans, a smaller proportion of deposits to assets, smaller average savings per member, charged more on loans, paid less on deposits, and showed a larger spread. While there were no statistically significant differences in the return on total assets, smaller credit unions maintained a larger proportion of interest-earning assets to interest-bearing liabilities. These results were quite consistent for both 1990 and 1994, except for the liquidity area. While smaller credit unions maintained greater cash positions, when "Investment Securities" were added, the larger institutions showed the higher ratio.

Results of the comparisons of stable and unstable credit unions are mixed. For the smaller institutions, the findings are largely as hypothesized. For larger credit unions, the distinction between stable and unstable parent company business tended to fade out. Several possible explanations can be suggested for these findings. One, as credit unions become larger as a result of the growth of their respective parent companies, more natural product and geographical diversification takes place. This diversification tends to reduce parent company influence. Second, parent company subsidies are often reduced as companies grow larger, as does the strength of the common bond. Lastly, as credit unions increase in size, they utilize more professional management and fewer volunteers, which, in turn, may result in better management decisions.

Results of the time series comparison of 1990 and 1994 reveal interesting trends. Beginning with the sample size, the number of small credit unions decreased by 37 percent (i.e., stable institutions decreased by 35 percent, unstable ones by 42 percent), while the number of large credit unions increased by 28 percent (i.e., stable CUs increased by 29 percent, unstable CUs by 25 percent). In 1994, delinquency rates were down for all groups, as would be anticipated in comparing a year which contained a recession (1990) versus an expansionary year (1994). Capital positions increased for all groups, as did provisions for loan losses. In contrast, loan-to-savings ratios were down for all groups. Spread ratios increased for small credit unions and remained relatively constant for large institutions.

V. SUMMARY AND CONCLUSION

This study tested for differences in operating behavior among credit unions by size and type. The results indicate statistically significant differences in all six areas of operating characteristics. Nearly all the results for the comparison of small and large credit unions were as anticipated. Also, size groupings of stable and unstable credit unions revealed the hypothesized relationships with the exception of the largest sizes of credit unions. With large credit unions, the impact of parent company business diminished in importance.

The implications of these findings to shareholders, managers, and regulators are that the unique symbiotic relationship between a credit union and its parent organization makes the study or the management of such institutions without concern for the business of the parent and the size of the institution a questionable practice. Simply stated, a credit union is not an independent financial institution; rather, its behavior is very much affected by the institution's size and the nature of the parent company business.

REFERENCES

Benston, G. J., "Economies of Scale in Financial Institutions," Journal of Money, Credit and Banking (May 1972) pp. 314-341.

Black, H. and R. H. Dugger, "Credit Union Structure, Growth and Regulatory Problems," Journal of Finance (May 1981) pp. 529-538.

Flannery, M. J., "An Economic Evaluation of Credit Unions in the United States," Federal Reserve Bank of Boston, Research Report #54, 1974.

Kohers, T. and D. Mullis, "An Update on Economies of Scale in Credit Unions," Applied Economics (20, 12, 1988) pp. 1653-1659.

Kohers, T. and D. Mullis, "The Effects of Parent Company Business on Occupational CreditUnion Behavior," Applied Economics (18, 12, 1986) pp. 1311-1322.

Kohers, T. and D. Mullis, "The Impact of Credit Union Parent Company Business on Borrower-Saver Treatment," Review of Business and Economic Research (Fall 1987) pp. 38-49.

Koot, R., "On Economies of Scale in Credit Unions," Journal of Finance (September 1978) pp.1087-1094.

McNulty, J., Verbrugge, J., and D. Blackwell, "Thrift Scale Economies: An Alternative Approach," Quarterly Journal of Business and Economics (Summer 1995) pp. 47-59.

Murray, J. D. and R. W. White, "Economies of Scale and Economies of Scope in Multiproduct Financial Institutions: A Study of British Columbia Credit Unions," Journal of Finance (38, 3, June 1983) pp. 887-902.

Navratil, F. J., "An Aggregate Model of the Credit Union Industry, " Journal of Finance (3 6, 2,1981) pp. 539-549.

Smith, D. J., "A Theoretical Framework for the Analysis of Credit Union Decision Making," Journal of Finance (September 1984) pp. II 55-1168.

Smith, D. J., T. F. Cargill, and R. A. Meyer, "An Economic Theory of a Credit Union," Journal of Finance (May 198 1) pp. 519-528.

Taylor, R. A. "Economies of Scale in Large Credit Unions," Applied Economics (March 1972) pp. 33-40.

Wolken, J. D. and F. J. Navratil, "Economies of Scale in Credit Unions: Further Evidence," Journal of Finance (June 1980) pp. 769-777.